Merchant Guide

Merchant Account Setup, Use, Fees, Chargebacks & Return Transactions

Our Payment Partners

Set Up Process

You're Connected, Now What?

Chargebacks & Returns

PCI Compliance

Periodic Reviews & Other Requests

FAQs

Our Payment Partners

Our Payment Partners

With TapGoods integrated payment processing, you receive benefits like click to request, click to pay, recurring payments, automated final payments, and more, all included with your subscription. These actions can occur with one simple action or can be automated in your settings leaving no action required by you or your team.

Here at TapGoods we have taken careful consideration in choosing the perfect payment processing partner. Our primary partner, Launchpay, fully integrated with TapGoods PRO and supported by the TapGoods team, will underwrite and onboard all clients enabling you to accept payment cards. Fiserv serves as the clearing and settlement platform with Launchpay and Silicon Valley Bank, a division of First-Citizens Bank & Trust Company as a sponsor Bank managing payouts. Our partner, ACHQ, will function in a similar capacity for ACH payments (ACH is available for US clients only).

Managing your transactions is made easy with your payment portals provided by Launchpay Backoffice (Credit Cards) and PaymentKeys (ACH). You can find more details on this in this section: You’re Connected, Now What?

Set Up Process

Set Up Process

The new merchant onboarding process can take 7-14 business days from the time the application is successfully completed to the time connections are approved and made. This timeline can vary depending on the needs of underwriting. We ask that you take time and care when filling out your application to lessen the likelihood of receiving additional requests from the underwriter. Check out these sections to learn more about the set up process.

Application Process

You will receive an email invitation to fill out the merchant application. Follow the steps below to begin your application. We suggest reading over Important Information Before Beginning Your Application ahead of time so you are fully prepared.

- Click the link in the email and use the email address that the link was sent to as your username.

- Click Register, and set up your password and log in.

- Once you are logged in, claim your application and fill out all fields.

- Make sure you have all documents needed, found in this section: Documentation Needed.

- Make sure your Legal name, DBA name, business address, physical address, and tax ID are correct before submitting.

- After you submit, download and save a copy of your application and your terms and conditions.

Documentation Needed

You will need a clear copy of your driver’s license/ID card AND one of the two following documents on hand to submit and upload with your application. Underwriting will only accept one of the documents exactly as described below.

- A printed voided check, noting the following requirements:

- The name on the check must match the legal name of your business or the DBA.

- Nothing is to be crossed out, e.g. address.

- VOID is written in the middle so that account numbers, address, etc. all remain visible.

- DO NOT HAND WRITE DETAILS IN PEN – ONLY THE WORD VOID WILL BE ACCEPTED HANDWRITTEN. ALL DETAILS MUST BE TYPED AND PRINTED ON THE CHECK.

OR

- A bank letter statement, noting the following requirements:

- The letter must be printed on a bank letterhead.

- The letter must be signed by a bank manager with their contact information, and include the business DBA or legal name, bank routing number, and bank account number.

Important Information Before Beginning Your Application

- Most communication will be sent to you via email from

payments@tapgoods.com and Underwriting request emails from Launchpay New Accounts portal. Please ensure these email addresses are on the ‘allowed’ list in your inbox and check your Junk folder often. These emails will come from no-reply@merchantapp.io. - We recommend starting the application when you can use the same computer to complete it and can allocate 25-30 minutes to the process.

- We advise you to use a Google Chrome browser to complete your application. We also recommend using a private or incognito browser to eliminate errors.

- Please be sure to have all documentation ready to go prior to starting your application – documents as listed in the Documentation Needed section, taxpayer ID #, account number, etc.

- A secure link with instructions will be emailed to you and only good for one time use.

- If you need to pause the application and log back in later to complete the process, you must use the following link: http://merchantapp.io/tgpayments.

- If you have forgotten your password, please use the Password Reset button.

Ensuring a Timely Turnaround

- Check your Launchpay New Accounts portal often for updates from the Launchpay Underwriting team. They will sometimes request additional information there. You will also receive email alerts so please check your junk/spam folder if you do not see anything.

- Provide all requested information as quickly as possible.

- Answer all questions as accurately as possible, i.e. average credit card transaction amount, average monthly processing volume, etc.

- Be aware that if you have your credit report locked for fraud or other reasons, underwriting will need to schedule a call for security purposes. Our goal is to keep you safe!

You're Connected, Now What?

You’re Connected, Now What?

Congratulations! You are ready to start processing payments through TapGoods, and we are here to help your business run smoothly and grow. Find details on transaction processing timing, fees, and the online portals in this section.

Online Portals

You will access your payments portals with the following details. All payment card transactions will be shown in the Launchpay Backoffice, and all ACHQ (digital bank/digital check) transactions will go through the PaymentKeys Portal.

Launchpay Backoffice – Credit Card Transactions

The login for this portal is the email address you completed the application with. You will gain portal access once your first transactions have been completed and will simply use the forgotten password option to reset your password and log in. You can access the portal HERE.

DOWNLOAD THE LAUNCHPAY BACKOFFICE GUIDE

ACHQ PaymentKeys Login – Digital Bank/Check

You will be emailed unique login credentials at the time of connection. Please login to the portal as soon as possible and update the login name (admin only) and password to credentials only you know. You can access the portal HERE.

Processing Fees

You will incur processing fees from both Launchpay and ACHQ. Please see below for more information.

The transaction processing fees for Launchpay are deducted once a month and will appear as a debit via TGPayments on your bank statements. You are always able to view a summary of all fees on the Transactions tab in Launchpay Backoffice. The fee rates for Launchpay are listed in detail at this link. The transaction processing fees are deducted once a month and will appear as TapGoods charges to your payment on file for your TapGoods PRO subscription. You will receive an itemized invoice for these fees via email from the TapGoods Operations team. The fee rates for ACHQ are listed in detail at this link. Launchpay Credit Card Processing Fees

ACHQ Processing Fees

Deposits & Transactions Timing

Launchpay Credit Card Transactions

Payment card transactions take 2-3 days to be deposited into your bank account and can vary depending on the time of day the transactions are processed or if it is a holiday or weekend.

Please note transactions settled at the end of the day will be available for review the following morning in Backoffice HERE.

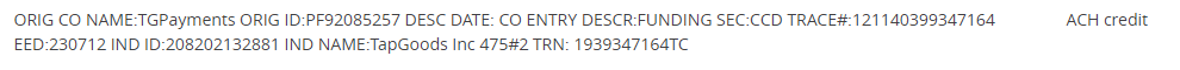

The transaction deposits are credited periodically into your bank account and will appear as a credit via TGPayments on your bank statements. Please see the screenshot below for an example of what a deposit may look like in your bank account.

Click Image to Enlarge

If you have any questions regarding your processing fees or deposits, please reach out to payments@tapgoods.com.

ACHQ Transactions

ACHQ transactions take 3 business days to post as they are digital checks. Funds are deposited on the 3rd business day after the debit posts.

Our default ACH settlement time is 3 business days. An example of this is shown below.

- Monday – Payment instructions received from TapGoods. ACHQ creates ACH files and sends to the Fed.

- Tuesday – Debit effective (posted) to customer’s account - beginning of 48 hour ACH return window (Day 1).

- Wednesday – Hold for returns, second half of 48 hour return window (Day 2).

- Thursday – End of 48 hours that started Tuesday morning - process any final returns that may have come in overnight and create a settlement file. Send settlement file to Fed (Day 3).

- Friday – Settlement effective in merchant account.

How To Request a Bank Account Change

Launchpay: Download THIS FORM and fill out all required details. Your Merchant ID can be found by logging in to your Backoffice portal account. You'll also need to provide a voided check or signed bank letter. Send the completed form and the check / letter to payments@tapgoods.com and we will submit everything on your behalf. Reach out to payments@tapgoods.com with any questions or to obtain your Merchant ID.

ACHQ: Fill out THIS FORM and you are all set! No further action required - TapGoods Payments team will confirm when the bank account has been updated

DOWNLOAD THE BANK CHANGE REQUEST FORM

Chargebacks & Returns

Chargebacks & Returns

TapGoods, Launchpay, and/or ACHQ are not responsible for any chargebacks or returns. Chargebacks are disputes initiated by cardholders through their financial institutions, typically when a consumer feels they have not received a good or service for which they have paid. We do our best to assist you in filing disputes, but your customer’s credit card company/bank or the card brands themselves make the final determination.

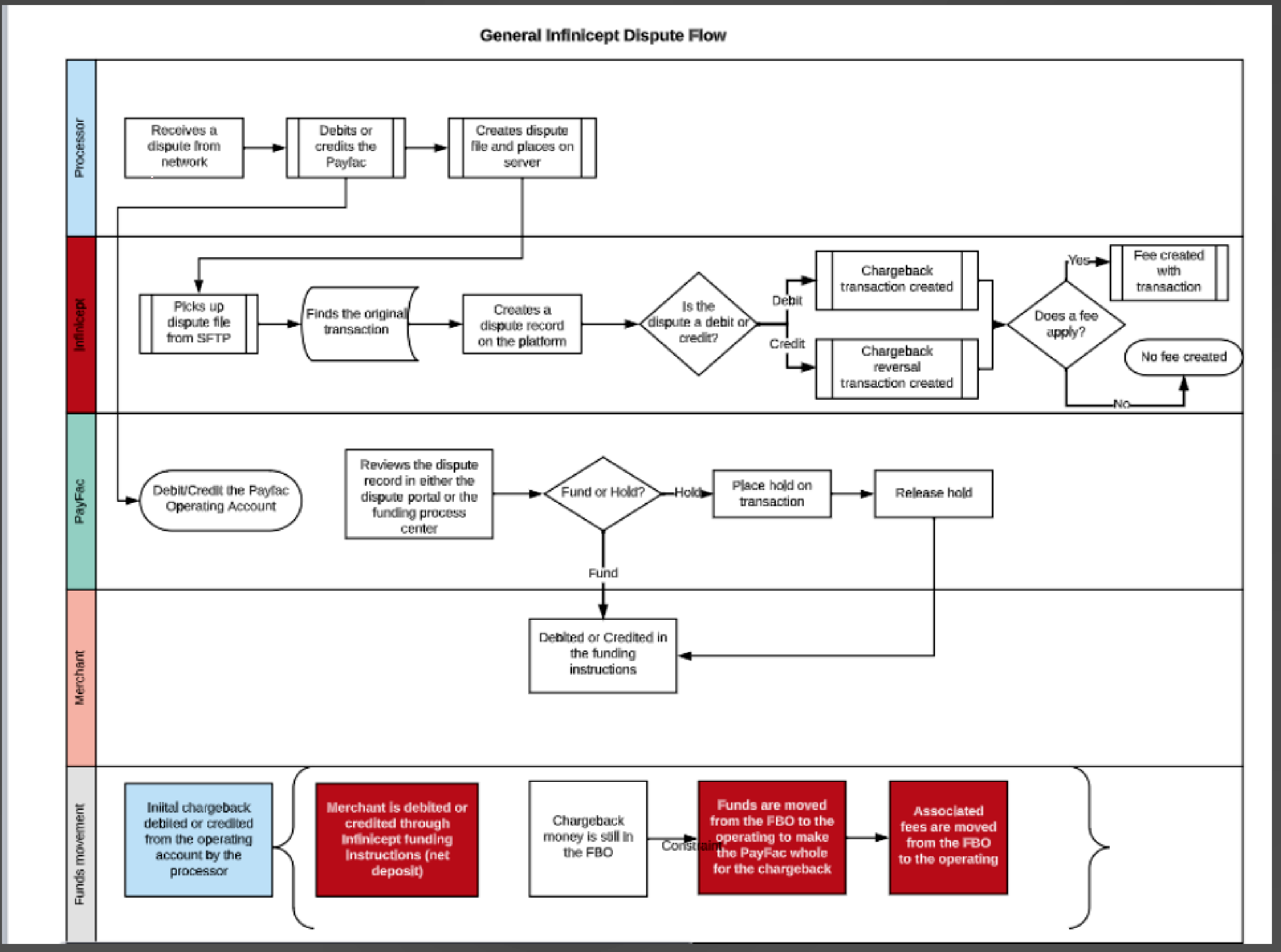

Credit Card Chargebacks

A chargeback, also known as a dispute, occurs when a customer (cardholder) challenges all or part of a payment with their card issuer, often for one of the reasons listed below. The card issuer immediately reverses the payment and creates a formal chargeback, refunding the chargeback to the customer and applying a chargeback fee to your account. You can dispute the chargeback, providing documentation that the payment was valid. If the payment is determined to be valid, the disputed amount is credited back to your account. If the chargeback is upheld, the cardholder’s payment remains refunded. Below is a helpful flowchart outlining the chargeback process:

Click Image to Enlarge

You will be notified from Launchpay immediately when a chargeback is issued against your business. You will receive an email from the TapGoods Payments team at payments@tapgoods.com with a subject line of Action Required: Chargeback Notification. You can view all chargebacks including pertinent details and status within your Launchpay Backoffice portal under Disputes. Upon receiving notice of a new chargeback, you have a few options to respond to it, found below in the section Options For Responding. If you wish to dispute the chargeback, you will use the self service Dispute tab in Launchpay Backoffice to upload your evidence and document any helpful notes. Feel free to reach out to the TapGoods Payments team with any assistance you may need. This process is expected to take approximately 60 days from the date of documentation received by Launchpay. Results are rarely provided to Launchpay earlier than 30 days. Any signed invoices, contracts, sales slips, card imprints, or other documents bearing the signature of your customer. Additional options: The chargeback email notification will also outline all documentation that could help your case. Chargebacks are commonly categorized into one of two types: Card Present (CP) or Card Not Present (CNP). Outlined below are some helpful tips for each category. Card Present The most frequent tip to avoid card present chargebacks is to capture all transactions by chip reading the card or obtaining a magnetic swipe. Acquiring and using a TapGoods Point of Sale (POS) device can be extremely helpful in avoiding card present chargebacks. Increasing your chances at winning a card present chargeback would include providing a sales draft with proof that the transaction was electronically captured and providing evidence that the transaction was processed using a PIN-enabled terminal where the payment physically occurred via chip/PIN/EMV. Card Not Present To prevent card not present chargebacks, it is strongly advised to obtain authorizations for all transactions. The most common authorization is an agreement between your business and your customer with a valid signature. Another example is a proof of delivery of items, ideally with a valid signature as well. TapGoods clients have the option to upload images to their orders upon delivery – an easy way to obtain the information needed to fight a chargeback quickly! For any type of chargeback, compelling evidence is the best way to defend yourself. Compelling evidence is the strongest consideration of a financial institution to remedy a chargeback, and it varies based on the type of chargeback. If you’d like us to provide a list of these items for a specific type of chargeback or for any other information, contact our Payments team at payments@tapgoods.com. Common Reasons That Customers Issue Chargebacks

Options For Responding

What documentation should I provide?

Possible Outcomes

Best Practices to Avoid & Win Credit Card Chargebacks

ACHQ Returns & Chargebacks

An ACH return occurs when the receiving bank rejects the transaction, and, just like a credit card chargeback, an ACH chargeback occurs when the receiving bank account holder disputes the transaction.

TapGoods will communicate via email to our clients when either of these occur. Unlike credit cards, ACHQ returns and chargebacks are more difficult to counter and typically require a business to work directly with their customers.

It is important to understand that excessive levels of ACH Returns and Chargebacks cost you time and money. All returned ACH transactions incur a $5 per transaction return fee and chargebacks incur a $25 per transaction fee, all of which can be found on our Payment Processing Fees page linked HERE.

Best Practices to Avoid ACH Returns

Below are some things you can check with your clients to prevent frequent ACH returns.

- Insufficient Funds: The bank account must have sufficient funds to debit the account.

- Correct Bank Account Number: The receiving bank will return an ACH transaction for an unknown or incorrect bank account number. Please confirm with your client that they input the correct account and routing numbers.

- Customer Advises Not Authorized/Stop Payment: You will want to communicate with your customer what will appear on their bank account statement. You will also want to ensure all services/products are rendered in a timely manner.

PCI Compliance

PCI Compliance

What is PCI Compliance?

The Payment Card Industry Data Security Standard (PCI Standard) is an information security standard for any organization that processes, stores, or transmits cardholder data.

Why Should I Become PCI Compliant?

PCI Compliance will help you to avoid a data breach – 43% of cyber-attacks target small businesses which could result in loss of revenue, fines, lawsuits and more. And PCI compliance is required to accept credit card payments.

Payment Card Industry (PCI) Data Security Standard (DSS) compliance is designed to protect businesses and their customers from credit card theft and fraud. All businesses or service providers that store, process, or transmit payment card data are required to comply with the data standard – regardless of business size or the amount of annual payment card transactions.

By completing the free survey, you gain $100,000 in breach assistance and avoid a $25 monthly Non-Receipt of Validation fee assessed by our partner.

How To Become Compliant: TapGoods PCI Compliance Program

TapGoods partners with our merchant processor, Launchpay, and our PCI partner, MAXpci to provide you with a seamless PCI compliance program. You will receive emails directly from MAXpci with information, instructions, and resources to complete the annual questionnaire. The simple 5 step process is as follows:

Step 1: Log In

Go to PCI Compliance Portal and enter:

- Username: Your Merchant ID Number

- Initial Password: Comply1!

Step 2: Answer Key Questions

- Do you store cardholder data electronically? Select No.

- Choose your processing method:

- If you do not use a POS device: Select “My customers either click on a link to make a payment or are taken to a third party’s site to pay.”

- If you use a POS device: Select “I use a terminal that uses an IP-based connection.”

Step 3: Complete the Questionnaire & Scan

- Answer a short set of security questions.

- If applicable, perform a quick security scan.

Step 4: Attest & Obtain Your Certificate

- Review and submit your attestation.

- Receive your PCI compliance certificate.

Step 5: Meet the Deadline to Avoid Fees

Complete this process within 60 days to avoid a $25.00 monthly PCI non-compliance fee.

TapGoods PCI Resources

General Information:

PCI Website

Launchpay User Guide

Launchpay PCI Compliance Video

Questionnaire Guide & Additional Help:

PCI Step by Step Guide (POS Device Users)

PCI Step by Step Guide (Non-POS Device Users)

MAXpci Customer Support

- Phone: 800-803-8515

- Email: support@maxpcicomply.com

- Live Chat: Available on their website.

Periodic Reviews & Other Requests

Periodic Reviews & Other Requests

At TapGoods, we want to provide information transparently so that our clients are aware of all processes that may come up during their normal course of business. If you have an active merchant account through our partner, Launchpay, your business is subject to periodic reviews or other information requests as deemed necessary. This is a standard practice for merchant account providers to protect your business, your customers, and the provider.

Why are periodic reviews performed?

When you signed up as a merchant, Launchpay and their underwriters collected information such as your business type and processing volume to help assess what to expect from you as a merchant. As you grow, these things may change, and it is important to keep an accurate snapshot of your business. These reviews are an industry standard and in most cases, federally mandated. The intent of the review is to gather updated business information to support processing levels to protect everyone involved in the transactions.

What can I expect during a review?

Launchpay will notify TapGoods if a client has been triggered for a review. This can happen at any point during the life of your merchant account. TapGoods will then reach out to you with the requested information.

Depending on the reason for the review, Till may request one or all of the following documents:

- Recent bank statement(s)

- Prior year tax returns

- Previous or YTD financial statements, including balance sheet and income statement

- More information about your projected growth and volume in the next year

Once Launchpay receives the requested documents, they will contact us with any further questions or needs. It is common that they will have follow up questions to better understand the documents or request a second year of documents.

What happens if I don’t provide the documents requested?

If Launchpay does not receive the documents requested, Launchpay may, at its discretion, limit your processing amount and/or hold reserves on your account.

What can I do to help avoid periodic reviews or other flags on my account?

While merchants are always monitored and reviewed for irregularities, you can do a few simple things to help mitigate requests. If any of the following instances apply to your business, we recommend reaching out to TapGoods to notify us so we can be sure Launchpay is aware.

- Processing volume spikes annually or semi-annually

- Income increases due to a new large contract

- Average dollar per transaction has changed

- Business type has changed

- Business information as changed (address, phone number, tax ID, etc)

Any other important information I should know?

The documents you provide are able to be submitted via a secure link provided to you from Launchpay. It is also important to note that there is a confidentiality clause in your agreement with Launchpay, stating they cannot share the information you provide. This ensures your information is protected at all times.

Finally, make sure to do your own periodic review of your merchant account terms and conditions to keep refreshed on what you’ve agreed to. TapGoods and Launchpay are here to support business growth while remaining secure and protected.

Please reach out to our Payments team at payments@tapgoods.com if you have any other questions or concerns regarding reviews.

FAQs

Why do I have to provide my personal information such as SSN on my application?

As a responsible financial institution, our partner takes our commitment to safeguarding our clients' financial transactions seriously. The stringent policies and procedures are designed to not only comply with applicable regulations but also to protect your business and our organization from potential risks and fraudulent activities. The collection of personal information is an essential part of this commitment, and here is why each piece of data is necessary:

- Name: Your full name is a primary identifier, ensuring that the account is registered under the correct business entity. It also helps us in maintaining accurate records and addressing any account-related issues promptly.

- Social Security Number (SSN): We request the SSN to verify the identity of the business owner or authorized signatory. This adds an extra layer of security to the account and helps in preventing identity theft and fraudulent applications. It also assists us in meeting our regulatory obligations.

- Date of Birth (DOB): The DOB is another critical piece of information used for identity verification. It helps us confirm the applicant's age and identity, reducing the likelihood of unauthorized account access. It also aids in compliance with age-related restrictions, if applicable.

By collecting this information, Launchpay can ensure that your business account is opened securely and that both parties are protected from potential fraud and misconduct. Additionally, these measures help maintain a high level of trust and integrity in our relationships with our clients.

It is important to note that all collected information is handled with the utmost care and in full compliance with all relevant data protection and privacy regulations. There are strict data security protocols in place to safeguard your information and prevent unauthorized access.

If you have any concerns or questions regarding the collection of this data or how it is used and protected, please do not hesitate to reach out to our Support or Payments team here at TapGoods. We are committed to providing you with transparency and ensuring that you are comfortable with the information you provide.

What type of merchant account will I have and what are the benefits?

You will have a Payment Facilitator, or PayFac, merchant account when you sign up via TapGoods. This is a payment service provider for merchants that allows TapGoods to own the relationship directly with our clients. The benefits include faster underwriting and onboarding, less risk for your business, additional customer service surrounding your transactions, and more. To learn more about our partner, Launchpay (an Infinicept company), and this type of merchant account, click here.

Can I decline to take a certain type of payment or credit card (i.e. ACH, AMEX)?

You are unable to decline a certain credit card type such as Visa or American Express via the merchant processor. TapGoods allows you to add a note to your customers stating to not use a certain type, but the payment will not be blocked via your merchant account.

You are able to decline ACH processing if you choose to do so. Please note that you cannot have ACH processing without credit card processing. To decline ACH processing, simply tell your Onboarding Specialist or Relationship Manager, or email payments@tapgoods.com and we will be happy to disable it for you.

Can I restrict a certain type of payment or credit card during certain time frames in TapGoods (i.e. within 7 days of event start date)?

Unfortunately, we are unable to restrict payment or card types during certain windows at this time.

Why can’t I use my existing merchant processor when I sign up with TapGoods?

The TapGoods platform seamlessly integrates with our preferred partners only. Connecting to our merchant partner, Launchpay, will also allow you to receive added customer service related to payments within TapGoods.

Will I incur fees if I process a refund? Will I get my processing fees returned to me if a payment is refunded?

When you process a refund, your business won't face extra fees and the customer receives a full refund. However, the initial transaction's processing fees are not returned to your business.

When and where can I expect to receive tax statements such as a 1099-K?

Tax statements are sent out by January 31st via postage mail from:

LAUNCHPAY LLC

543 SANTA FE DRIVE

DENVER, CO 80204

You are able to view all accumulated fees paid for the year by logging into your Backoffice portal HERE. Within the portal, select the date range, export your file, and sum the fees.

If you do not receive your tax forms, please reach out to our Payments team at payments@tapgoods.com.

If you were processing via Till Payments in 2023, tax statements from Till are also sent out by January 31st via postage mail. You can view your total annual fees paid at the bottom of your merchant statements, or by logging into your Till Merchant Portal HERE.

How can I update my bank account on file for deposits from my merchant account?

Launchpay: Download THIS FORM and fill out all required details. Your Merchant ID can be found by logging in to your Backoffice portal account. You'll also need to provide a voided check or signed bank letter. Send the completed form and the check / letter to payments@tapgoods.com and we will submit everything on your behalf. Reach out to payments@tapgoods.com with any questions or to obtain your Merchant ID.

ACHQ: Fill out THIS FORM and you are all set! No further action required - TapGoods Payments team will confirm when the bank account has been updated.