Choosing the right equipment for your rental business is a big decision. It’s not just about what you think might be popular. Making smart choices is important, especially when you have a budget to stick to. Before you spend any money, it’s a good idea to figure out the potential Return on Investment (ROI) on the equipment. Equipment ROI means understanding how long it will take for the equipment to pay for itself and start making you money.

We’ll go through three ways to calculate equipment ROI so you can see how much value the equipment could bring to your business. Then, we’ll show you how to use an equipment ROI calculator to quickly calculate equipment ROI without the hassle!

1. The Payback Period Method for Calculating Equipment ROI

The Payback Period Method is a straightforward way to figure out how long it will take for an investment to start paying for itself. In other words, this is an extremely easy way to calculate ROI in the short term.

When starting a rental business, you can use this method by dividing the cost of the equipment you buy by its yearly profit. The answer tells you how many years it will take for the equipment to earn back the money you spent on it, which is essential when calculating equipment’s overall ROI.

How The Payback Period Method Works

Let’s say you buy a piece of equipment for your rental business for $10,000, and it helps you earn an extra $2,500 each year. To find out how many years it will take to pay off the equipment, you would divide the cost of the equipment by how much money it helps you make each year. In this case, $10,000 divided by $2,500 equals 4 years. This means it will take 4 years to get your $10,000 back.

This method is popular because it’s easy to use and gives you a quick idea of when you’ll start making a profit from your investment. But remember, it doesn’t consider other costs you might have or any money you make after those first 4 years. This means this method may not give you the most fleshed-out idea of the total ROI.

Pros of The Payback Period Method

- Understanding and calculating ROI is straightforward, making it accessible even for those without extensive financial knowledge.

- It provides a fast way to evaluate the return on investment, showing how long it will take to recover the initial outlay.

- It helps identify investments that pay back quickly, potentially reducing the risk associated with longer-term financial commitments.

- Useful for comparing multiple investment opportunities, helping to prioritize those that recover costs faster.

Cons of The Payback Period Method

- It only focuses on the period until the initial investment is recovered and does not account for any profits or cash flows after this period, which means that it does not give you a full picture of your ROI.

- Because it only looks at how quickly money spent is recovered, it does not evaluate the total profitability or overall return of an investment.

- The method may favor investments with quick returns over those that may be more profitable in the long term but take longer to pay back.

2. The Accounting Rate of Return Method for Calculating Equipment ROI

The Accounting Rate of Return (ARR), also known as the Simple Rate of Return, method calculates ROI by accounting for the average yearly profit you can expect as a percentage of your investment. To find the ARR, divide the average annual net income by the initial cost of the equipment.

How The Accounting Rate of Return Method Works

Let’s say you’re considering buying a new sound system for your rental business. The system costs $20,000 and is expected to generate an average net income of $5,000 annually. To determine the ARR, you would calculate $5,000 (average annual net income) divided by $20,000 (initial cost), resulting in an ARR of 25%. This percentage helps you understand the yearly return on your investment compared to its cost.

Pros of The Accounting Rate of Return Method

- Unlike the Payback Period Method, ARR provides insight into the profitability of an investment, not just how quickly it pays for itself.

- Easy to calculate and understand, ARR gives a clear percentage result that indicates the earning efficiency of an investment.

- Helps predict future profits, aiding in more accurate financial planning and budgeting for your business.

Cons of The Accounting Rate of Return Method

- ARR calculations do not consider the time value of money, which can lead to overestimating the attractiveness of longer-term investments.

- It focuses on net income rather than cash flows, which can be misleading if the investment impacts cash flows differently due to varying costs like maintenance or upgrades.

3. Net Present Value Method (NPV) for Calculating Equipment ROI

The Net Present Value (NPV) method is great for evaluating investments because it helps you see the value of future cash flows in today’s dollars. This method balances the incoming and outgoing cash related to an investment, adjusted for its time value — essentially, it tells you if the money you make from the investment is worth more than what you put in.

Overall, this is the method we recommend to get the best calculations for whether a piece of equipment is worth investing in for your rental business.

How The Net Present Value (NPV) Works

In the past, calculating NPV could get quite complex, requiring a present value table and a detailed formula. However, with modern tools like Excel or Google Sheets, this process is now much simpler. We’ve set up a Google Sheet that does the heavy lifting for you! This is one of the best ways to calculate your equipment investment return.

To use this sheet, you’ll need to know the following information:

1. Determine Your Discount Rate

The NPV method’s first step is to decide on a discount rate. You expect to earn this rate as a return on your investments. For instance, if you’ve found through experience that returns below 30% aren’t satisfactory, then you’d use 30% as your discount rate. This is your benchmark for comparing potential investments.

2. Calculate Your Net Cash Flows

Next, you’ll need to estimate the net cash flows that your investment will generate over its useful life. To do this, follow these steps:

- Determine how often the equipment will be rented out during the year and the rental fee per event. Multiply these numbers to estimate how much revenue the equipment will generate annually.

- Figure out all expenses related to the equipment, including maintenance, repairs, and any staffing costs directly linked to its operation. Don’t forget to include the costs of supplies or additional services necessary for the equipment. Subtract these expenses from your total estimated revenue to find your gross cash flow.

- Consider the tax implications of your revenue and expenses. Calculate the tax you’ll need to pay on the earnings from the equipment.

- If you financed the purchase of your equipment, include the interest payments as part of your costs. This will give you the net cash flow from the investment.

Once you’ve made these calculations, you have the information available to you to do this calculation!

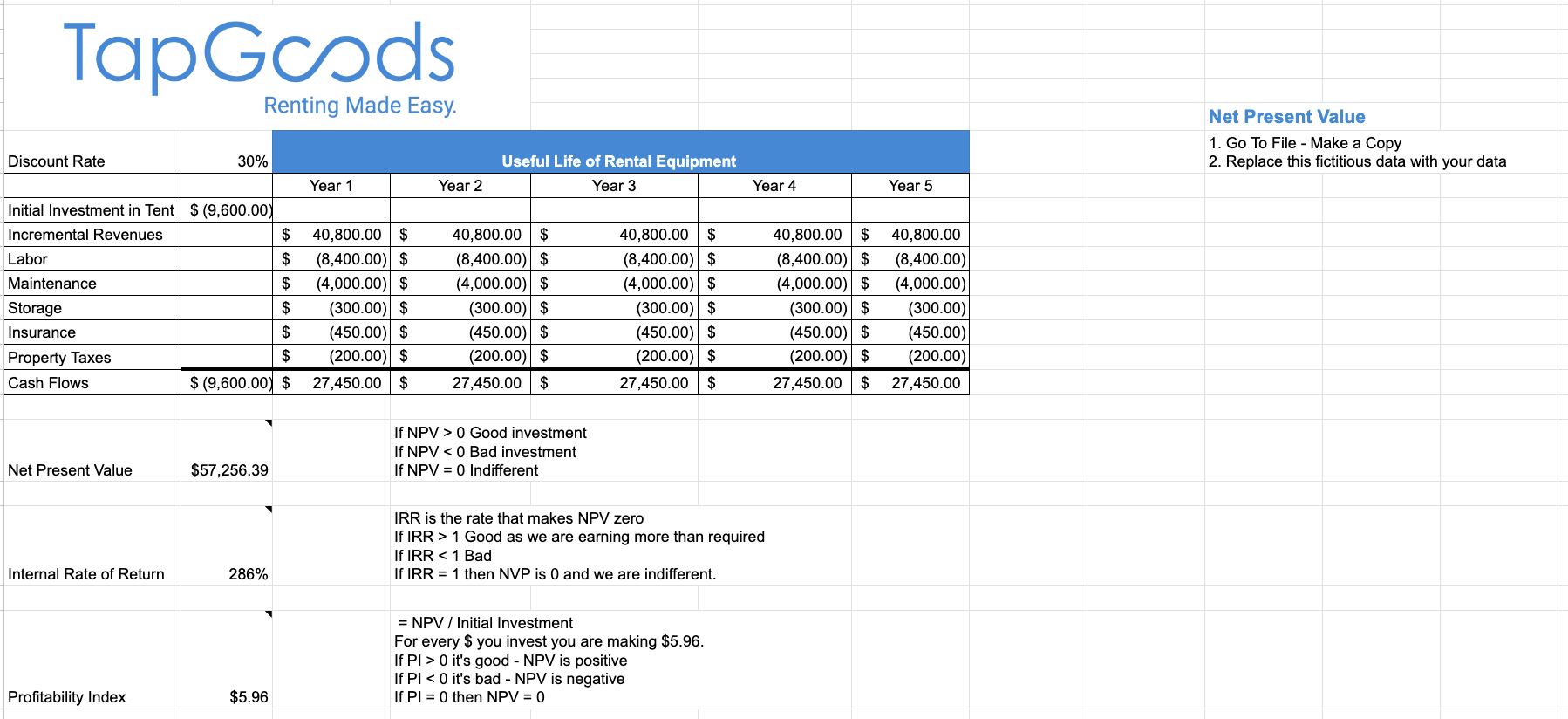

Example of NPV Using Our Calculator

Imagine you’re considering a $9,600 investment in a party tent. According to the calculations in our Google Sheet, the NPV of this investment is $57,256.39, indicating a financially sound investment. Remember, this figure considers not just the cost but also the potential earnings from renting out the tent.

While the financial side looks good, it’s important to remember the practical aspects. Tents require more effort to deliver, set up, and maintain. They also need trained staff and carry more liability. However, offering tents can attract larger events because many customers prefer to rent all their needed items from one company. If you don’t offer tents, you might be missing out on these opportunities.

The spreadsheet we provided automates the NPV calculation. As a rule of thumb, if the NPV is greater than $0, it’s a good financial investment. If it’s less than $0, the investment would underperform compared to your discount rate. An NPV of $0 means the investment just meets your required return rate.

Pros of The Net Present Value (NPV) Method

- Offers a precise measurement of an investment’s profitability by considering the time value of money.

- Evaluates both the incoming and outgoing cash flows over the entire lifespan of the investment.

Cons of The Net Present Value (NPV) Method

- While tools have simplified this calculation, understanding and setting up the correct parameters can still be challenging.

- Accurate NPV calculations rely heavily on the accuracy of the estimated cash flows and discount rates.

Other Tools for Evaluating Investments for Rental Businesses

Internal Rate of Return Method (IRR)

Think of the IRR as the break-even rate of your investment. Technically, IRR is the rate that sets the Net Present Value (NPV) to zero. This means the IRR compares the cash flows generated by the investment with the discount rate your company requires.

For instance, if you decide that an acceptable return is 30%, and the IRR exceeds this, then it’s considered a good investment. You can easily calculate the Internal Rate of Return using this Google Sheet. Remember, if the IRR is greater than 1, your investment is earning more than what’s required by your discount rate, making it a solid choice. If the IRR is less than 1, it’s not meeting your financial goals.

Project Profitability Index (PPI)

The PPI is an excellent tool for comparing multiple investment options. Start by calculating the net present value of each option. Next, calculate the Profitability Index by dividing the net present value of the project by the initial investment required. This measure is highly useful when evaluating several investment opportunities simultaneously. For example, if the Profitability Index is $5.96, it indicates that for every $1 invested, you are generating $5.96 in return.

Simply visit this Google Sheet to handle the calculations. As a general rule, a Profitability Index greater than 0 indicates a good investment (positive net present value), while a PI less than 0 indicates a poor choice (negative net present value). If PI equals 0, then the net present value of the investment breaks even.

When comparing several options, the Profitability Index helps you determine which investment will yield the largest return for every dollar invested today.

Ready To Get Started?

Investing in the right equipment is crucial for the success of your rental business. By using the tools and methods we’ve outlined—like the Net Present Value, Rate of Return, and Project Profitability Index—you can make informed decisions that will drive profitability and growth. Don’t just guess; use these proven strategies to ensure your investments pay off.

Start now by checking out our easy-to-use Google Sheet for calculating these financial metrics. It’s designed to simplify your investment evaluation process, helping you focus on growing your business with confidence.

Invest smart and watch your rental business thrive!

Other blogs you may find helpful:

5 Reports that Rental Businesses NEED to Review Frequently

The Importance of Equipment and Party Rental Contracts in 2024

A Step by Step Guide to Becoming a Preferred Vendor at an Event Venue

Frequently Asked Questions

The rental rate can be calculated by determining how often the equipment will be rented out during the year and the rental fee per event. Multiply these numbers to estimate how much revenue the equipment will generate annually.

Charging for equipment usage typically involves setting a rental rate based on the frequency of use and the type of equipment. This can be a flat fee per period (day, week, month) or a variable rate based on the duration of use or the specific usage circumstances.

To calculate the payback period, divide the cost of the equipment by the profit it makes each year. For example, if a piece of equipment costs $10,000 and generates an extra $2,500 each year, the payback period would be $10,000 divided by $2,500, resulting in 4 years.

To calculate ROI, you can use one of three methods: 1) Accounting Rate of Return (ARR), where you divide the average annual net income by the initial equipment cost. 2) Net Present Value (NPV), which subtracts the initial investment from the present value of future cash flows, adjusted for time value; a positive NPV indicates a good ROI. 3) Internal Rate of Return (IRR), which finds the rate that sets the NPV to zero; an IRR above your discount rate means the investment exceeds expectations.

Net Present Value (NPV) is calculated by balancing the incoming and outgoing cash related to an investment, adjusted for its time value. You’ll need to estimate the net cash flows the investment will generate over its useful life, considering revenue, expenses, and tax implications, and then choose a discount rate reflecting the return rate expected on investments. Subtract the initial investment from the present value of these cash flows to get the NPV.